Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Everything to Know about Website Valuation

Have you ever wondered what makes a website valuable? What made Tumblr worth millions of (and by some accounts, more than a billion) dollars? Yet, if we look at where most acquisitions occur, most websites sell for under $100,000? What forces are at work that influence a business or individual to make an acquisition?

Maybe you’ve sold a business in the past. Maybe you’ve already started the process of selling your current business. Whatever the case, we’ve put together this guide to help you understand what makes an online business valuable. If you understand the underlying forces that influence value, you can apply that knowledge to help make your own business more valuable.

If you want to understand your business better, and establish a fair and accurate idea of its value, then this guide is for you. You’ll develop a general idea of how much your business could potentially earn you if you sold today, and—better still—you’ll learn how to identify the areas where you can improve your business to boost its value.

What will this guide teach me?

The Goal of this Guide

Our goal is to give online business owners a tool with which they can reasonably predictthe market value of their business within a given range of values. We do this by offering them a valuation formula, and breaking it down into individual, easy-to-understand steps and metrics.

The Three Key Motivators

As a business owner, you’ll learn how to optimize the market value and the desirability of your business to potential buyers. We want to help you gain an understanding of the factors that influence a valuation—and the buyer’s perception of your business’ value—that’s built on three key motivators: risk, potential, and transferability.

Not All Valuations are Created Equal

Before we jump into the details of all the items that could influence the value of your website, it’s important that you understand that not all valuations are created equal. Why? Well, there are two reasons. First, not every person who asks for a valuation actually wants to sell or is thinking about selling their online business. In cases such as divorces, partnership disputes, or in some cases seeking a loan, a court or a bank may request that your business receive a professional valuation. These would be considered formal valuations. Second, most valuations only look at your website from the perspective of the marketplace of potential buyers.

Formal vs. Informal Valuations

Establishing a fair and accurate value for your online business requires careful consideration of a number of factors. And in doing so, it’s very important to keep in mind the distinction between a formal valuation—i.e., a legal process used to determine absolute value in order to establish someone’s net worth, evaluate their worthiness for a loan or line of credit, or allow for the sale of a business between two parties—and a”thumbnail,” or informal, valuation. A thumbnail valuation is less complicated and isn’t legally binding, but it does provide insight into your business, its value in the marketplace, and the changes you can make to improve that value. While formal valuations have their place in a legal context, thumbnail valuations are useful if you want to position your website to be sold at some point in the future. With this guide, our primary concern is the latter method of valuation. We want to help you predict how much a buyer would be willing to pay for your business, and form a proper exit strategy.

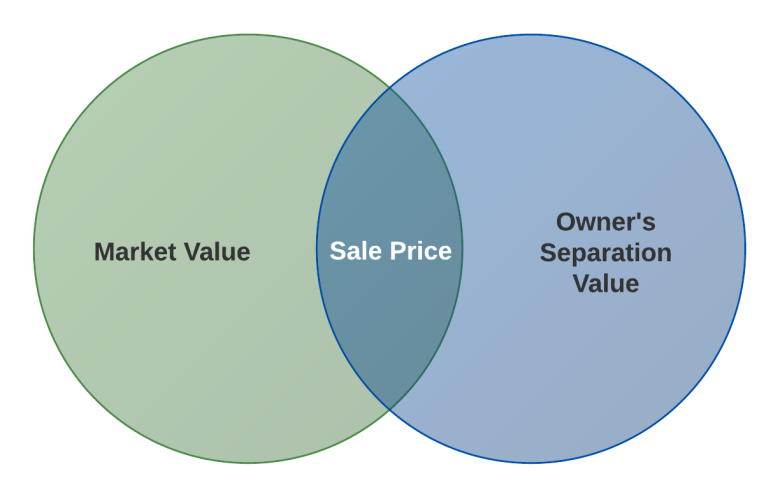

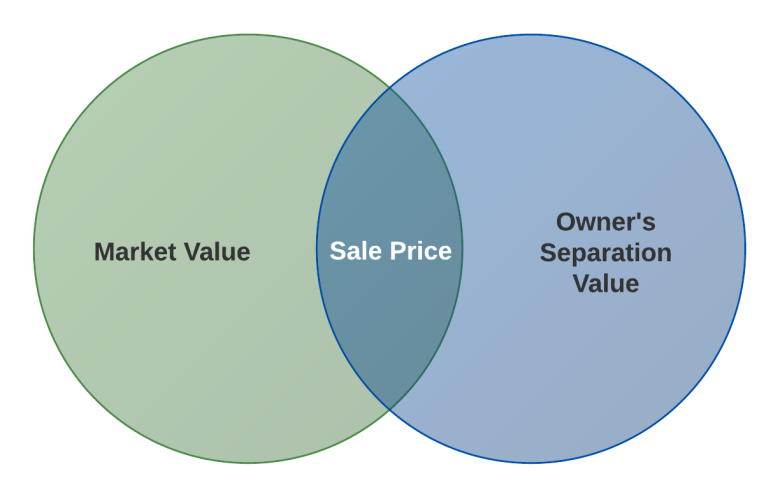

A Balancing Act: Market Value vs. Owner Separation Value

You’ve probably seen or even tried a few free valuation tools online. They all promise to give you top dollar and take-it-to-the-bank accuracy, but the truth is, you have to balance your expectations against the tool’s capabilities and the realities of your particular business. A fancy formula can spit out a great number for your business, but if there isn’t a person on the other end of that formula with a checkbook who is willing to write that check, the formula is worthless. Put simply, a business is worth whatever someone is willing to pay for it. Our purpose with a valuation is to predict what this number will actually be in the marketplace, and to use this value as a predictor of what you can ultimately expect to receive from a buyer. So while our purpose is to predict what the marketplace value will be for your business, we should also mention another important valuation point: the value to the business owner. Reaching this value requires consideration of two key influences: the value assigned by the marketplace, and the goals and desires of the current owner. The Market may be willing to pay the market value for a business, but for the business owner (you, for example) it may not make sense to let go of the business unless you get a higher value than the market will pay —the owner’s separation value. In order for an acquisition to be done, these two values have to intersect in some way.In determining a sale price, the acquisition value may be higher than market value, as some buyers are willing to pay a price closer to the owner’s separation value in order to acquire the business. But even so, the transaction will never happen if the acquisition value doesn’t match the owner’s own valuation.

Here’s the Takeaway

As a business owner, you also have a say in the value of your business — even if you can’t directly change the marketplace value.

Some people get offended when they hear the market valuation of their business. They take it as an insult to what they built, although of course that’s not the intention. It’s important to remember that a valuation isn’t some sort of “report card” on how you’ve built your business; it’s simply a measure of what the market is willing to pay for a business. For some owners, it’s very possible the business could be significantly more valuable to retain than sell.

So Why Is the Market Value Often Lower than Owner Expectations?

In more than half of the valuations we perform at Quiet Light Brokerage, owners expect higher valuations for their businesses than the market is willing to pay. So why is market value often lower than owner expectations? Risk. Both buyers and sellers take on risk during the sale of a business, and while potential buyers take on the lion’s share, it’s very easy for sellers to lose sight of this. If you get caught up in the risks you’ve personally taken on with your business, you might struggle to accept the amount the market’s willing to pay (as opposed to the amount you want or need). For buyers, motivation comes from a desire to earn a return on their investment, but also to avoid risk. And buyers are asked to assume risks the sellers never see, specifically:

- Their Upfront Investment is at Risk. A potential buyer is generally asked to stake significant upfront money—more money than the business in question makes in a given year. And should the business fail for some reason, the buyer—unlike the current owner—stands to lose not only the income generated by the business, but the upfront investment they made to purchase the business.

- They Lack Intimate Knowledge. A potential buyer does not have the same intimate knowledge of the business as the current owner. Therefore, it’s much more difficult for them to assess its value. Unsurprisingly, buyers will generally discount the business’s value to account for the unknown.

By understanding what motivates buyers, and the risks they have to take, you can begin to see why there’s often such a marked difference between what you want as a seller and the price buyers are willing to pay. And once you understand how these factors overlap, you can begin working to close the gap.

Chapter 1. Understanding and Calculating Website Value

At Quiet Light Brokerage, our approach (and the approach we want to teach you) is metric-centric—but it also includes several qualitative assessments to help us discount or add value to each individual business valuation. We wrote this guide in large part to provide you with a solid overview of the qualitative factors that play the biggest role in influencing value, as well as the metrics that are most important in determining value. The valuation formula you’ll learn about in this guide will help you get the most accurate valuation for your online business, for two important reasons:

Our Formula Excels for Market-Based Transactions

Alternative valuation models exist to calculate the value of online businesses, but this formula is a longstanding industry standard for market-based acquisitions. The vast majority of acquisitions occur within the marketplace.

Most Buyers Rely on This Formula

As it’s the standard method of calculation, most buyers generally follow the same formula (or some similar variation of it). Consequently, using it gives us more accuracy when predicting what a buyer will be ready to pay.

The Valuation Formula: The Earnings Multiplier Valuation Method

Don’t let the fancy name fool you. It might sound super technical, but in reality it isn’t difficult at all. This formula consists of 2 basic metrics: seller’s discretionary earnings and a multiplier. Written out, it looks like this:

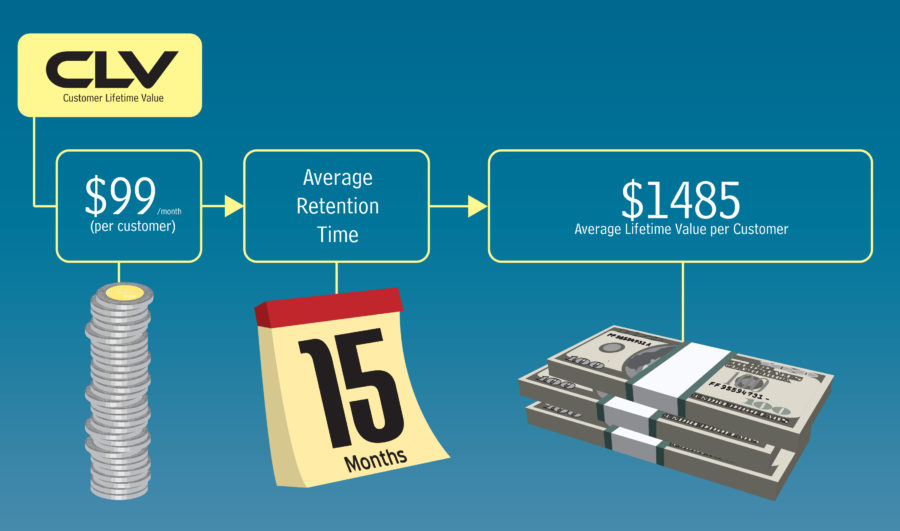

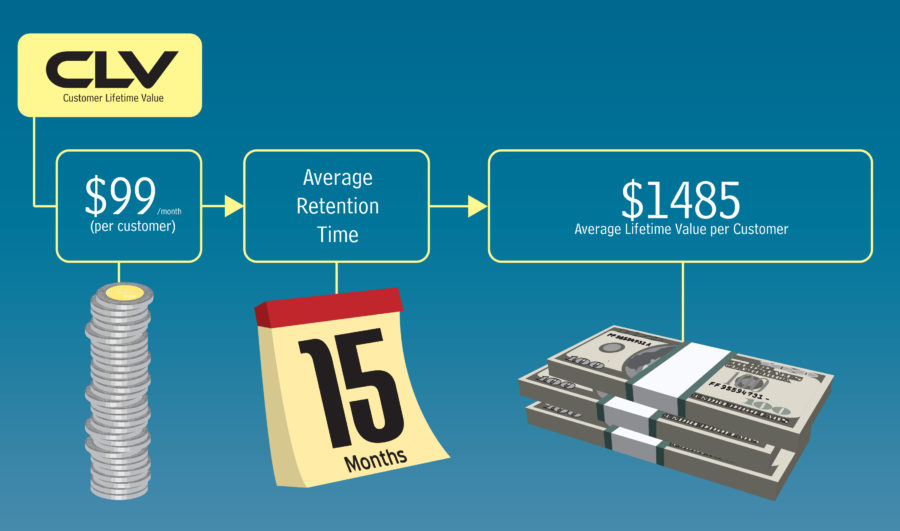

Seller’s Discretionary Earnings x Some Multiple = Internet business valueSeller’s Discretionary Earnings

The seller’s discretionary earnings are closely related to a business’ profitability, although the calculation of seller’s discretionary earnings is slightly different from the one used for profits. We’ll get into how this is calculated in a future chapter.

The Multiple

You can think of the multiple as a number (or, more properly, a number range) used by buyers and sellers to give a business a “score” based on their expectations for a return and the risks the business has as an investment. A number of factors influence the multiple; we’ll be examining these factors in a later chapter. Let’s focus a bit more on what’s behind a multiple.

What Does The Multiple Measure?

Making a Simple Formula More Complex

When people see the valuation formula written out, they sometimes assume it’s too simple. They may think it relies too heavily on earnings, without leaving enough room to account for a business’s intangible elements such as a great domain name, or high rankings in the search engines, or a beautifully designed backend system. In reality, however, the multiple accounts for these intangibles. It acts as a “catch all” number to evaluate all of the other criteria of a business. Despite being a part of a very simple formula, the web of influences that affect a multiple is actually quite complex. Before we get into the details, however, let’s understand the multiple conceptually.

About Those Online Valuation Calculators…

Calculators can be quick, easy, and they can certainly be fun if they tell you your website is worth millions of dollars. But we strongly encourage you to avoid basing ANY business decision on data from an online calculator.

How Reliable Are Online Calculators?

The short answer: not very. Without specific information on your business, niche, and unique circumstances, they really do nothing more than make a poor guess. These tools are, at best, fun novelties.

The Concept of Multiples

The Multiple is a Measurement of Expected ROI.

Buyers buy because they want a return on investment (ROI). Even if the buyer is making a philanthropic acquisition (e.g., they buy a website because it contributes positively to society through charity, etc.), they are looking for a return in the form of a positive impact within their community. Altruism aside, most buyers will likely want a monetary return on investment, too. The multiple is a measure of the buyer’s confidence in the ROI and their expected level of return.

The Multiple is a Measurement of Risk

The multiple is discounted for risky investments. For non-risky investments, buyers are willing to pay higher multiples. This brings us back to the first point: buyers buy to get a ROI. For any acquisition, as long as the business continues to be healthy, a buyer will receive a return on their investment. But the buyer is always aware of risk and the factors that could cause their investment to be lost. The multiple takes this awareness of risk, and the risk itself, into account.

The Multiple is a Measurement of Opportunity

The multiple speaks heavily to opportunities for growth or improvement as well as existing profitability and sustainability. As with risk, opportunity has significant impact on ROI. Businesses with a lot of “low-hanging fruit” will receive higher multiples. If you establish potential for growth in your business, it will yield a higher multiple for interested buyers than your business’ discretionary earnings would suggest on their own.

The Forces That Influence Multiples

Two distinct forces are at work when determining a multiple: market conditions and business-specific conditions. Understanding both is essential to maximizing your multiple.

Market Conditions

As a general set of factors, market conditions have a wide, very general impact on the multiple range buyers are willing to pay. Market conditions include: the general economic climate; the number of people who are looking to invest in online businesses; the state of the current investment marketplace; the specific niche in which a business operates; the current lending environment; and the perceived risk associated with Internet businesses. Example: An e-commerce store that dropships furniture, at the time of this writing, will have a general marketplace multiple of anywhere between 2.3–3.2. This number includes market conditions such as how many people are interested in dropship businesses that sell furniture, and the general marketplace attitude toward such businesses. If market conditions change, however, this can influence the multiple range. For example, if the lending environment dries up (as it did during the Great Recession), the multiple ranges will drop. Warning: Website Buyer Reports on Industry Multiples Some companies develop reports analyzing the current asking prices of businesses for sale, organized by business type (e.g., lead generation, SaaS, e-commerce dropship, etc.). These companies list general prices for niches and business types, and are reporting on the market-level influence of the multiple. It is extremely important to note that these companies report only asking prices. The actual sale points for these sites are not publicly available, making them a mystery—and this data unreliable.

Business-Specific Conditions

The specific condition of your business helps determine where it will fall within a multiple range. Strong businesses will be at the top of their business type range (or may even exceed it), while weak businesses will hover towards the bottom of the range (or break through the bottom to unsounded depths). Your business’ profits, performance history, and potential for growth all play a part in calculating business-specific conditions. Multiples are roughly analogous to a scaled grading system. During calculation, your business will be compared to other similar businesses, and the relative strengths and weaknesses of your business will be weighed against other possible opportunities for buyers. It’s possible for many different companies to earn an “A” in the buyer’s gradebooks, with each earning their “grade” in a different way. Ultimately, however, most buyers rate the majority of businesses far below “A”. Unless you completely change your business model, it’s unlikely you’ll be able to break too far outside of your niche’s industry multiple range. However, you can work to make sure your business rises to the top of its multiple range—or even slightly above it.

Optimizing Your Multiple has Diminishing Rates of Return

Optimizing the value of your business is like wearing a bungee cord with one end tied to a stake in the ground. The stake represents the middle of the valuation range. You can move away from this middle value—in either direction—fairly easily at first. But as you move farther and farther away, the bungee cord will exerts its resistance, impeding progress. Eventually, the bungee will put up so much resistance that we can’t go any farther. This is the same as optimizing a business’s value. Optimization exhibits a declining rate of return. If optimization doesn’t bring the multiple to where they want it, buyers will simply look at other businesses for sale.

Can We Go Higher Than Our Multiple Range?

Breaking out above your business’ multiple range to become an outlier is possible, but unusual. Going higher than your industry’s range requires a perfect blend of conditions, along with a hefty dose of luck. But you should be careful. Often times, when a buyer is willing to pay an outlier price for a business it is an indication that they don’t know what they are doing. Such an occurrence can come back to haunt the seller if the buyer later returns to exert a legal claim that the seller misrepresented the business.

Chapter 2. The Four Drivers of Value

Focusing on the Most Important Motivating Factors

We will begin with a look at some of the most common factors that influence a multiple. Every business is different, and it’s impossible to imagine every scenario that might crop up during valuation and sale! So rather than attempt to be a comprehensive compendium of wisdom on this topic, we’ll examine the most important guiding principles that influence multiples.

A Complex Blend: Individual and Collective Influence on the Multiple

Because there are so many factors involved in valuing and selling a business, you and your buyers should consider the impact of not only single factors on your multiple, but the influence they exert collectively. The central motivation driving each buyer varies from person to person, and the influence each factor has on the multiple can vary from deal to deal. Some factors may cancel each other out, or interact with one another to improve value, or, as individuals, have little to no influence on the multiple at all. It’s important to remember, however, that any single factor (or combination of factors) that adds an inordinate amount of risk to your business can have a disproportionate impact on the multiple. Regardless of a buyer’s motivation, however, we can safely assume that buyers buy because they want a strong return on investment, or ROI. But how does a buyer determine if a specific acquisition will be provide a sufficient ROI, and what areas can you, as a business owner, optimize in order to attract buyers and complete your sale? Setting aside the complex nature of influential factors and their collective impact, the three bedrock principles that matter most when calculating a multiple are risk, potential, and transferability.

Motivator One: Risk

As a business owner, both you and your buyer are taking a variety of personal and professional risks with the sale of your business. However, the buyer bears the bulk of this risk as the individual who is assuming ownership and taking on, rather than shedding, the responsibilities, earnings, and potential problems of the business.

Why is Risk So Important?

Risk is a strong influencer because of the potential losses a buyer can experience if their acquisition does not go as planned. Buyers weigh the potential benefits against several risk-related factors, including:

- Buyers typically get one crack at making a good investment. Most buyers do not have the luxury to make more than one or two mistakes when making an acquisition. If a buyer acquires a business that fails, that buyer typically loses the ability to make further acquisitions. To combat that risk, they need a high level of assurance that their limited resources are applied to strong investments.

- Buyers invest multiple years of earnings upfront. In addition, buyers are typically investing several years’ worth of earnings from their new business up front. When selling a business on an earnings-based multiple, you are effectively asking the buyer to make a substantial investment based on the idea that the business will perform near, at, or above the levels it has performed in the past. Not only does a buyer risk this upfront capital, but they also take the risk of losing out on other opportunities during the time that they are waiting for this investment to pay back their original funds.

- Investment of Time and Other ResourcesMany buyers commit heavily in terms of time and ancillary resources. In addition to losing out on already invested capital and forgoing other potential opportunities, a bad online investment involves time spent on a failed project—time that cannot be recouped. Funds are not the only investment the buyer makes in an acquisition; for most buyers, an acquisition takes a significant emotional toll addition to the financial burden.

- The Unknown When a buyer is presented with something unknown, they will tend to assume the highest level of possible risk for that unknown. Because of this assumption, if your business has a high number of unknowns due to a lack of tracking data, then it’s likely your business will be regarded as a high risk investment. We’ll return to this point later, but for now, keep in mind this phrase: “The more tracking data, the better.”

Some Buyers LOVE Risky Businesses

Some buyers look specifically for lucrative businesses, primarily because they know the substantial downward pressure on the multiple means they can get a significantly higher return on their investment if the risk is never realized. If you have a risky business, there’s no need to give up hope. Just remember that, while the market for such businesses exists, the multiple will always be heavily impacted by both the risk and the buyers it attracts.

Motivator Two: Potential

Although most buyers would be loath to admit it, potential has the ability to place upward pressure on a multiple. Inversely, a business that lacks such growth opportunities can experience downward pressure on its multiple.

Why Is Potential Growth Important?

Buyers want a strong ROI, and they typically want it as quickly as possible. If a business grows substantially after a buyer acquires it, they’ll likely receive a faster recovery of the funds they’ve invested, along with higher satisfaction. That said, a buyer’s desire for growth usually extends beyond immediate gratification, and is based on a wider spectrum of factors:

- Growth Offers A Higher Effective Return on Investment Assume a buyer acquires a business for $150,000. At the time of the acquisition, the business earned $50,000/year. At that earning, the buyer will effectively have a 33% annual return on their investment. Now assume that the buyer doubles earnings to $100,000. Not only will they recoup their initial investment more quickly, but their annual effective rate of return will jump to 66%. Try getting that in the stock market.

- The Growth in the Value of the Asset. As a business grows its earnings, the value of the business itself typically increases along with the earnings. Consider the example where a buyer doubles the earnings of an acquired business from $50,000/year to $100,000/year. Not only is the buyer’s effective annual rate of return higher, but the value of the business itself also increases substantially. To keep things simple, if the buyer acquired that business for $150,000, they could now possibly sell the business for $300,000. The buyer receives a 66% annual earnings return on their original investment, and can also double their original investment.

Warning: “Potential” Could Lower Your Multiple. Using the word “potential” often causes a buyer to ignore the rest of your message. Why? Many people who are selling describe the potential of their business, but they fail to distinguish between the aspects with a clear path to growth and those requiring a lot of assumptions in order to see growth. Blue Sky Potential vs. Real Potential? Real potential includes any activity with a clear path to increased profitability, along with some idea as to what the growth will look like. Each business is unique, so it is impossible to come up with a comprehensive list. However, we’ve gathered a few examples to illustrate areas with real growth potential.

- A History of Growth. Buyers and sellers can often look to the history of a business and make a judgement as to whether or not growth is in its future. For example, if a business has grown 10-15% every year for the last 5 years, buyers have good reason to believe it will continue to grow at some rate.

- Low Conversion Rates. If the conversion rates on your site are lower than average, and if you have never worked to optimize them, this minor area of potential growth can be attractive to motivated buyers.

- Unused Assets What’s an unused asset? Let’s say your business has an active email list of past customers that’s never been properly monetized, or an Adwords account that’s performing moderately well, but has never been optimized. These assets are being unused, or underused, and offer clear paths to new growth—along with some risk of profit loss. We’ll take a closer look at unused assets in Chapter 3: The Basics of Value and Discretionary Earnings.

Warning: Stagnation Can Lower Your Multiple. If your business no longer has any realistic growth opportunities, then this can actually hurt your multiple. A business that’s stagnating or in decline often has significant downward pressure placed on its multiple because it doesn’t offer the upside benefits most buyers are hoping to find.

Motivator Three: Transferability

Transferability is the degree to which a potential acquirer can take over ownership of your business without any significant disruption in the day to day business as well as the degree of difficulty of transitioning the business.

Why Does Transferability Matter?

A successful business is a unique blend of intangible variables, conditions, and relationships that work together in a complementary way to build a profitable business. When a buyer decides to buy a business, they do so based on demonstrated past performance, as well as their best judgment of what conditions, variables, and relationships have come together to create that performance and make the business successful. In order to maintain or improve upon this success, buyers want to make sure the variables, relationships, and conditions were not unique to the person selling the business. If these factors are unique to the seller, then the potential return on investment could be jeopardized.

How Transferability Affects the Multiple

As you can probably guess, when a business is more difficult to transfer to a new owner, or if key parts of a business will not transfer (such as vendor relationships), this places extreme downward pressure on the multiple. Compare this to a highly transferable business, which won’t necessarily receive upward pressure, but will be able to maintain its multiple. Example A mommy blog that operates mainly on the original owner’s charisma, personal stories, and experience would have less transferability than a general parenting blog that isn’t tied to a specific “face” for the company.

Areas of transferability

We’ll look more closely at individual aspects that impact multiples in the next section of this guide, but conceptually speaking, the two main areas that impact transferability are the buyer’s personal attributes—their abilities, skills, knowledge, and training—and the existing relationships they have with vendors and clients.

Motivator Four: Ability to Verify Your Data

Once you have all the other factors lined up in your business to bring in a maximum return, then it’s time to prove just how strong your business performs. This means you’ll need to have verification, and the easier your business is to verify, the more a buyer will be willing to pay. Conversely, if it is impossible to verify your data, buyers will often reduce what they are willing to pay.

Why Does Verification Matter?

Verification matters for two major reasons:

- People make mistakes. Let’s face it: we’ve all made mistakes, especially when recording detailed information. For buyers, however, a simple misplacement of a decimal point or accidental omission of an expense can have a major impact on their understanding of the return they’ll see after acquiring your website.

- Some people are very dishonest. In the world of buying and selling online businesses, where many of the relationships never amount to any personal contact, there are bound to be a few dishonest people (some buyers will tell you there are more than a few). So as much as a buyer may want to trust that your information is full, complete, and honest, they’ll most likely want to verify this.

Besides these two driving reasons that make verification such an important aspect of your website’s value, having an online business that is easy to verify also helps to put buyers at ease that they are buying a well-built and well-organized business.

Difficult to Verify Businesses Appear Risky

Remember the #1 driver of your website’s value? It is risk. When a buyer assesses the riskiness of your web based business, they’ll look in two places. First, they’ll look to known and easily identifiable risks such as your SEO or vendor relationships. But they’ll also try to assess those risks that they are not able to identify. Forgive me for invoking an overused phrase in business, but buyers will grow wary of what they don’t know. If a business is difficult to verify or involves a very complex verification process, it will give off the impression that there will be unknowns, and this drives the price of your online business downward.

How Verification Impacts Your Website’s Value

The easier your online business is to verify, the more you will see a positive influence on value. On the flip side, if your business is difficult to verify or extremely confusing, you’ll see a negative impact on your business’s value. If your business is impossible to verify, you may end up with a completely unsellable business.

Easy Verification Can Fuel Interest

It can be easy to overcomplicate the ideas behind a business’s value. So, at the risk of being overly simplistic, it should be noted that having a clean, easily verifiable business actually fuel’s interest among buyers. This has a positive impact on your website’s value. The reason for this is simple: no one wants to waste their time. If your business appears complex and difficult to verify, a buyer may be wary of committing hours and money in due diligence only to find that important details were missed. On the other hand, if they know that they’ll be able to easily verify that what you’ve shown them is accurate and complete, they’ll be confident that their due diligence investment will be less.

What Makes a Business Easily Verifiable?

First, you need to have 3rd party validation of your metrics. In other words, a buyer won’t accept your financial report without also verifying those financials against bank statements, merchant accounts, and even your tax returns. The more you can offer 3rd party validation of your data, the more you’ll instill confidence and reduce the perception of risk. Secondly, you want your data to be clean. This simply means that you should avoid mixing data from other businesses or your personal life. For example, if you regularly use your business account to pay for personal expenses, it’ll become more difficult to verify this at a later date. Or if you explore a new business venture and run it through your existing business, this will confuse your data as well. The more you can separate your financial data and other data, the cleaner it will be.

Chapter 3. The Whole Picture: Earnings, Intangibles, and Benefits

Getting the price you want, and deserve, for your business requires an in-depth understanding of how businesses are valued in the marketplace. In chapters one and two, we took a look at the basic variables involved in determining the value of your business. Now, we’re ready to look at how the concept of applying a multiple to earnings is just the first step in properly valuing a business. Despite the sometimes complex interplay of factors involved in valuing a business, when we tell a seller they could get a multiple of their current earnings for their business, we’re still often asked why we only value the earnings of a company, and not each of its other benefits. The truth is, we take all factors into account when we calculate our valuations. Earnings are certainly central to finding your business’ value from the buyers perspective, but it’s absolutely essential to look beyond straight earnings and understand how less tangible factors can impact the value of your business.

Beyond Earnings: The Incredible Intangibles

It’s a common misconception that since the key metric used to value a company is its earnings, intangible benefits have minimal, or even no, bearing on the valuation. However, those intangible benefits almost always directly contribute to, and are realized through, earnings. So while they may not appear as a line item leading to the bottom line, these benefits create a greater probability that the business will earn more, be more successful, and have a greater overall value. For example, a company with a number-one ranking in Google will receive more traffic, which should lead to higher revenues. An extensive and proven email list encourages greater retention, which should lead to more repeat sales or revenue events. The benefits of items like these are an integral part of the earnings generated by a business.

How Tasty is that PB&J?

Some sellers think that a business’ total value comes from simple addition; they assume it’s as easy as adding together (for example) a domain name ($10,000), rankings ($50,000), and code ($10,000) to reach a total value of $70,000. But this “a + b + c” approach doesn’t take into account the fact that businesses, like so many other things in this world, are more than the sum of their parts. Think about a peanut butter sandwich. Bread, peanut butter, and jelly are all delicious on their own. But when you put them all together, the combination elevates all three and makes them taste even better. A peanut butter sandwich has more value than three piles containing peanut butter, jelly, and bread, both because of the work that went into creating it and the way the components work together to create something more appealing than any one part could on its own. Buyers view businesses like they do that peanut butter and jelly sandwich—they’re looking for the complementary blend of benefits that makes your business special. Ask yourself: how are your assets working together to create an attractive return? Just how tasty will your sandwich be?

About SWOT Analysis

Strengths add value to a business. A steady client list full of regular or buyers, a well-researched and targeted email list, or a strong track record of past profitability are all strengths.

Weaknesses decrease the value of a business. Some examples would be a trend of declining profits, a business that can only be bought by a certain type of buyer, or a presence in a niche that is in decline.

Opportunities increase the value of a business. Optimizing paid advertising, opportunity to add exclusive vendors, or an opportunity for an easy-to-add product or service all represent positive opportunities.

Threats can greatly reduce the value of your business. Over-reliance on a single vendor or too few clients, looming legal issues, or increase in competition are all potential threats.

How SWOT Can Impact ROI

Of course, not everybody likes their PB&J the same way. Because buyers are motivated by ROI, they take a careful look at every aspect of your business, and actively seek realistic opportunities to maximize their potential returns while reducing their risk as much as possible.

Earning a strong return with minimal risk requires an understanding of how all the aspects of your company—earnings and non-tangibles alike—impact your business’ productivity, profitability, transferability, and potential. Buyers evaluate these aspects based on their potential to land in one of four categories: Strengths, Weaknesses, Opportunities, or Threats (SWOT). Depending on how these benefits impact your business, they can raise or lower its value.

Tapping the Potential of Unused Assets

Naturally, neither you nor your buyers can categorize an asset properly if it’s not front and center. If you’re like many other business owners, you probably have an unmonetized asset or two hiding in plain sight.

For example, you may have developed an email list and never marketed to it. Or perhaps you have a potential product line that fits your niche and would expand your market presence, but haven’t acted on it. Assets such as these hold value, but that value remains theoretical until they’re activated. Sellers need to wake up these assets, unlock their reach and potential, and invest time and capital into them if they want to get real value.

Of course, you should also consider leaving a few pieces of “low-hanging” fruit for a buyer as well. Remember that buyers are motivated by growth prospects as well as risk and transferability. Keeping a few, selective assets available can push your multiple higher.

That said, if you can add significant monetization through an untapped asset, you should do that first and foremost since earnings is such a key part of your valuation.

Does a Website’s Replacement Value Factor into a Valuation?

We’re quite often approached by business owners who have a fully built website or service, asking for the “replacement value” of what they’ve already built. The problem with this approach is that it does not take into account the factors that actually matter to people looking to buy an online business. Buyers are looking for a return on their investment—not a flat numeric value for a website. The codebase of a fully developed (or partially developed) service or website has value, but it’s like trying to sell an egg from an unknown bird: most of its value is locked behind the wall of potential. Before you try to sell your buyer a phoenix, you need to make sure you’re not offering them a pigeon egg. A comprehensive look at the business, rather than simply totalling up assets, will help you and your buyers understand the true value of what you’re selling.

Chapter 4. Cashflow, Expenses, and Income—Oh, My!

Cashflow, Expenses, and Income

Many people use the terms “cashflow” and “income” interchangeably, but these terms often represent entirely different values—and one can be more valuable than the other. The chief difference lies in how you record your income and expenses. If you record your income and expenses at the time income is received and expenses are paid, then cashflow and profit/loss values will be the same. This method of accounting is referred to as cash basis accounting. However, most businesses are sufficiently complex to require a more common accounting method: accrual based accounting. If you’re using software to calculate your income and expenses, you already know most systems recognize a company’s income when it’s earned (not necessarily received), and expenses when they are incurred (not necessarily when they are spent). However, many systems also reconcile, or balance out, these two values at different times during a given period, which can draw a hard line between cashflow (the change in total liquid assets between the beginning of a period and its end) and income (the amount that’s left after expenses).

So What about “Seller’s Discretionary Earnings”?

For the sake of simplicity when we talk about valuations, we often refer to our valuation formula as “Income x Multiple”. But in reality we don’t use income, we use a figure called “Seller’s Discretionary Earnings”. A seller’s discretionary earnings, or ODE, is simple to understand once you flip the words around: they’re the earnings you (the owner) have to spend at your discretion. Because it’s a discretionary value, some expenses are not included in the calculation. For example, the salary you pay yourself as the owner of your business would not considered an expense in an ODE model.

How do you determine what qualifies as discretionary?

Calculating Discretionary Earnings

While calculating discretionary earnings does have some room for interpretation, there are rules to a proper calculation. Want to learn what they are? Check out this article which explains this calculation in more detail.

The rules regarding what can be accepted as a “discretionary” expense and what cannot be are fairly consistent regardless of location, with many buyers and sellers operating from a set of general guiding principles. Even so, not all buyers will understand or agree with the rationale behind these calculations, and you should be prepared to explain and account for each item that falls under this category. When you prepare your business’s documentation, you should provide buyers with a schedule of expenses and revenues that were adjusted to arrive at your discretionary earnings. This will help them understand the larger picture and will also make financial verification much easier.

Disclosing Revenue

When you’re documenting revenue for your business, include only revenue related to the business in question. If you sell red wagons, but have a side contract to perform SEO for some real estate agents, then the revenue from that contract should not be included in your disclosure for your wagon business. If your business has income earned from accruing interest, leave that out as well.

Disclosing Expenses

When you calculate discretionary earnings, there will be some expenses that you add back into profitability. But even though you are adding some expenses back, you should always disclose these expenses and show that they are being added back. The reason for this is to reduce the possibility of surprises during due diligence. It also makes it easier to verify financials against tax returns and bank statements. Common expenses that can be added back are:

- Interest

- Depreciation

- Amortization

- Charitable contributions

- Federal and state taxes (but not mandatory sales tax)

- Individual owners income

- Any expenses that exist for your benefit as the owner (your daily coffee and doughnut are not going to be an ongoing expense for the new owner, unless you’re really persuasive).

In addition, one-time expenses are often added back entirely or amortized over several years. Don’t include unusual expenses that are not a normal part of doing business, such as unusual hardware, software, or equipment purchases.

Quick Tips for a Better Valuation

While you’ll always receive comprehensive assistance from our experts when you choose QLB to help you sell your business, following these quick tips can help you avoid some common missteps.

Dealing with Regular Infrastructure Updates

Major software updates your business will incur on a regular basis (e.g., website redesign occurring once every five years) should be represented in an amortized fashion and notated clearly for potential buyers.

Accounting for Multiple Owners

If your business has multiple owners, it is commonly accepted to add back one of the owner’s salaries, but not both. Any other owner’s salary should be adjusted to be commensurate with their work. Notations should always be provided if you are using this in a presentation to potential buyers.

Valuations Trail Back Twelve Months

Most valuations are based on the trailing twelve months’ worth of earnings by your business. What does this mean for you? Buyers (and brokers) will look at the most recent twelve-month history of your business and use that as the basis for its discretionary earnings. In the next chapter, we’ll take a look at how your business, its niche, and the marketplace all affect your website’s value.

Chapter 5. Health Check: How Marketplace, Industry, and Business Health Affect Vale

Even if your business specializes in vacuums, it doesn’t exist in one. Understanding the way your specific industry, and the marketplace as a whole, affects your business and its value is essential to a proper valuation. We’ve already seen how the industry sets a multiple range, and how the decisions you make (and actions you take) can affect your value within it. Now it’s time to turn our attention to how the health of your industry, the state of the overall marketplace, and your business’ overall suitability for both can impact your site’s value.

Your Business Needs to Be Healthy…

To get the valuation you want, you need a healthy business. Sounds simple, right? Buyers will evaluate the relative health of your business and its future worth based on their perception of your business and its viability, potential, and longevity. But it’s important to remember that you can’t consider your company’s health inside the narrow confines of your niche alone.

… And It Needs to Be Healthy All-Around

Your business’s health isn’t limited to its health within its niche. You may be the only business in the world offering blue widgets, but that doesn’t matter. Buyers want to see how healthy your business is compared to other businesses being sold, even if those other businesses aren’t selling blue widgets. You’re competing with everyone. Consider this: Buyers may look at a lead generation business one day which has a higher multiple range, and the next day look at dropship businesses which generally have a lower multiple range. The two businesses will be compared against each other for their history, their perceived stability, their perceived opportunities for growth, and for their perceived risk factors. In short, everything comes back to ROI. The buyer will try to determine the expected return each business will generate, and factor in the risks that could undercut their ROI.

Yes, Returns are Important

Yes, returns on investment drives valuations. Buyers want a return, so they take a very close look at the characteristics of your niche in addition to your business vertical and industry (and how these factors impact their ability to earn a return). They’ll also look at:

- How you’ve developed the business (and whether they can develop it further)

- How your business has performed over the years.

- What risks threaten their possible returns.

Master the Marketplace: Maximizing Your Valuation

Let’s say your business is healthy as the proverbial horse. As a business owner, you still have a lot of options within your unique space to maximize your valuation by keeping abreast of what’s happening in the marketplace as a whole. Let’s take a more detailed look at the variety of factors impacting valuations, and how you can influence them in your favor.

How Market Conditions Affect the Multiple

Market Conditions Impact Multiple Ranges

Your business exists within the broader market of businesses, so how that market performs impacts the range for which you can sell your business. A bull (or rising) market benefits your business, while a bear (or falling) market can lower valuation ranges and hinder your efforts to get the deal you want. Identifying the state of the market can help you plan ahead and adjust your marketing, expenditures, and strategy to make sure your business is performing optimally within the marketplace—and remaining attractive to buyers.

Market Ranges Change over Time

In the early 2000s, online businesses were being sold for multiples at 10x and above. During the great recession of 2007-2009, multiples topped out at around 2.6x – 2.7x. Good times or bad, ranges fluctuate based on general market conditions.

This is especially true with regard to the great recession. Because investors had less money, and were less willing to risk what they had, they limited their spending to very safe, very stable investments. Compared to more conservative investments, buying an online business is considered very risky indeed. In the recession, the combination of fewer investors and a much higher aversion to risk created a range of multiples that fell significantly short of the norm during more prosperous times. The lesson is this: pay attention to the economy. Whether it’s struggling or thriving greatly impacts your business. Adjust your goals to fit market conditions (e.g., don’t overextend yourself in a downturn), keep a tight rein on expenses, and be on the lookout for opportunities that will make your business more attractive to potential buyers.

Access to Capital

One of the biggest challenges for business buyers and owners during the great recession was the decision by the country’s banks to eliminate the majority of loans based on goodwill. Goodwill is an accounting term for all of the “virtual assets” and non-tangible value a business builds up, including its branding, reputation, and customer base.And despite the fact that bank-financed deals make up less than 5% of total transactions for deals less than $500,000, the decision to radically reduce goodwill loans removed a large number of buyers from the marketplace, leaving more leverage for cash buyers. To put it another way: banks removed buyers who needed loans from the market. This effectively limited demand, even though the supply of businesses for sale stayed the same or even increased. Decisions like these affect every business, regardless of industry, and can drastically reduce your pool of potential buyers.

How Popular is Your Niche?

Your business’s structure (e-commerce, lead gen, content site, SaaS, etc.) and your niche, or market segment, greatly impact the value of your business. These elements tend to be “bigger” than your business, but your business depends on their popularity or general acceptance to thrive. Should your niche grow in prominence, your business will become more valuable. If they look like they are in decline, that impacts the value of your business. Let’s examine some once-popular website models in this context.

MySpace Wallpaper Sites

In 2005, MySpace was the undisputed king of social networks. A lot of entrepreneurs built MySpace wallpaper sites that were monetized by Google AdSense or other third-party networks. For a time, these sites were highly valuable because they were so passive in their earnings, generating maximum return for next to no work. But as MySpace declined in popularity, so did the prospects for these sites. With the rise of sites like Facebook and Twitter, buyers moved on to greener pastures, and this niche quickly decayed.

AdSense Websites

From 2008 through 2010, AdSense websites were extremely hot commodities. If you owned a website that was monetized solely through AdSense, you could likely sell it for three times its annual earnings within a week—or even faster (we had multiple five- and six-figure deals that sold in less than 24 hours). But as Google rolled out Panda and Penguin updates targeting, among other things, AdSense-style websites based on “thin content,” buyers became nervous about acquiring them. However, some AdSense sites continue to hold value to this day, provided they have an extensive history and extensive, high-quality content that sets them apart from the thin content sites targeted by the algorithm updates Google released.

Memory Stick Businesses

Selling memory sticks continues to be a very viable business, but buyers are beginning to discount this niche because of the move by consumers to cloud-based storage. As it offers easy access and convenience comparable to memory sticks, this next-gen tech is quickly replacing physical media as the preferred choice for “access anywhere” storage. The memory stick business gives us an excellent example of a business likely to remain viable within its market, but with diminished importance thanks to more popular successors. Buyers will be less enthusiastic about these businesses, and selling a business like this will be a different experience than one based on more in-demand tech. This is different from the MySpace and AdSense examples, in that this business model’s presence in the niche isn’t completely destroyed; however, changing trends mean it will be much less appealing to buyers moving forward.

Electronic Cigarettes

There was a period of time in which we received multiple inquiries to sell electronic cigarette businesses. It became clear there was a potential issue in doing so, thanks to pending legislation and court cases focused on the regulation of the “e-cig” industry. Controversy isn’t always bad for business or demand, but being able to do business without a cloud of potential legal entanglements is still generally preferable for most owners. We noted with interest that, once the court cases were resolved, the inquiries to sell these businesses quickly disappeared. Today, electronic cigarette businesses are experiencing explosive growth and high(er) valuations thanks to industry growth and the resolution of legal challenges to the product itself.

Fads, “Deal of the Day” Sites, and the Copycat Effect

Fad-based businesses can generate a lot of short-term buzz and income, but they’re also risky to start. Buyers are generally smart enough to not acquire a business if they feel it is going to be nothing but a fading trend. Nobody’s lining up to by today’s Pet Rock if it’s going to be a drag on the market tomorrow. Of course, some businesses manage to rise above mere faddery and define a new kind of niche for themselves. Groupon, Woot!, Living Social, and other “deal of the day” sites are the perfect example of this phenomenon. In fact, the success of Groupon and Woot! led to a slew of copycat businesses. The imitators who were able to gain real market share early on found solid value in doing so. As the market became saturated and consumers paid less attention to deal of the day sites, however, late-comers to the niche—although conceivably viable for the long-term—lost significant value.

Stay Informed to Optimize Your Value

One of the secrets to maximizing your value is to recognize the broader trends of your industry. A good start is paying attention to your business model as well as the niche. If you are a lead generation business, understanding the history of the industry, its current status, and the ways in which it’s evolving can give you a deeper, more nuanced view of your individual business. Get a sense for the popularity and trends within your niche. Social media, news outlets, forums, and industry publications are all excellent sources of information for developing a comprehensive awareness of your industry. The more you know, the better you can inform potential buyers, and alert them changes to your industry or other factors beyond your control that can have a positive or negative impact on the value of your business in days, weeks, or years to come. With a little time and attention, you can learn to identify when an industry is peaking and when it is trending into outmoded or undesirable territory. This can give you an edge when starting, strengthening, or selling your business.

Chapter 6. Major Measurable Metrics I: Trending and Time Costs

In Chapter Five, we discussed the ways in which the health of your business and the overall marketplace can boost or lessen the value of the multiple. We now turn our attention to the largest of the numerous quantitative (i.e., measurable and tangible) metrics that can affect the multiple, and the overall value of your business. Dozens (if not hundreds) of variables exert influence on the multiple. And since the value of your business is determined by applying this multiple to the seller’s discretionary earnings (value = earnings x multiple), understanding these variables and their impact is crucial to getting an optimal value for your business. For most valuations, however, a common set of important metrics—financial trending, time cost, business age, financial margins, and traffic— have the most significant impact on the multiple. This chapter will examine the first two metrics—financial trending and time cost. Unless any one factor falls unusually far outside its norm, the greatest impact on your multiple will come from a combination of factors. Let’s take a more focused look at the five most important factors, and how they speak to risk, potential, and transferability.

Financial Trending

Each of the five factors we’ll explore contributes to their collective impact, but one of the most important is financial trending. The long-term performance of your business is one of the chief indicators buyers rely on when assigning value, and they will scrutinize all trends closely.

Why Financial Trending Impacts Multiples

You already know buyers are looking for ROI. Well, a business’s financial trend can be a strong indicator for a buyer who is trying to determine potential ROI. A growing business can indicate they’ll quickly earn a return on their investment, whereas a stagnant or declining business is likely to take longer to generate a return. Buyers are wary of businesses with negative trending, for three important reasons:

- A declining business will require more time for the buyer to earn back their investment.

- The relative ROI will be less than that of a growing or stable business.

- The value of the business itself will decline (remember, value = earnings x multiple. Smaller earnings mean the value of the business will continue to decline.

Consequently, the market is likely to punish a seller for a declining trend more severely than it is likely to reward a seller who’s developed improving financial trends.

A Step-by-Step Guide to Financial Trend Analysis

Want to learn how to do a detailed financial trend analysis? Click here to read our blog post on how to perform two types of financial trend analysis.

Most buyers will subject any and all trends to thorough scrutiny. Buyers are looking for reasons to say “no” to an acquisition that won’t benefit them, so they will analyze every trend they can find.

Which Trends are Analyzed?

A few of the most commonly analyzed trends include:

Temporal (Time-Based) Trending

The trends that emerge over a month, quarter, or year provide valuable insight to the long-term performance of your business. They also reveal how seasonal and/or cyclical your business is, and allows buyers to adjust their expectations and multiple accordingly.

Year- over-Year Trending

Year-over-year trending analysis compares similar months & quarters from different years. For example, you might compare January of this year with January of last year, or the third quarter of last year with the third quarter from two years ago.

Most businesses have some level of seasonality, and year-over-year trending allows you to see the peaks and troughs a business experiences over relatively long time periods.

Month-to-Month Trending

Most buyers look at to month-to-month trending first, even though it isn’t as representative of a business’ long-term performance as year-over-year is. Because they track more compressed time periods, month-to-month trends can sometimes inspire knee-jerk reactions from buyers who are ready to grant a quickly growing business a dramatically increased multiple. The other side of this effect is negative; should a business experience a declining trend month-to-month, and other factors aren’t considered, its multiple can drop like a stone.

Month-to-month trending provides important insight, but buyers (and sellers) should be careful not to approach it the same way they would (for example) day trading, and understand that each month exists within a series of months whose trends may have very different importance for the actual value of the business.

Quarter-to-Quarter Trending

As the name implies, quarter-to-quarter trending analysis looks at the series of quarters and the way a business performs within them. Quarter-to-quarter training analysis gives buyers a little more perspective than the month-to-month variety by increasing the timeframe being examined. The ebbs and flows of your business are more apparent, and it’s easier to develop more realistic expectations. This type of analysis is particularly important to businesses who have “boom” and “bust” months, where one or more months of high performance are offset by months with little activity.

Revenue Trends vs. Earnings Trends

In tracking trending over time, buyers will first look at the business’ earnings (revenue – expenses) within that time and how these earnings trend over months, quarters, and years. Earnings are not the only sub-metric within the financial trending metric, but they do provide the most useful and important data. However, a website owner should be careful to not sacrifice revenues for the sake of earnings alone.

Revenue Trending l

While buyers will normally look first and foremost at earnings, ignoring your business’s revenue trends is a risky proposition. Revenue trending is equally important when determining the health of a business. Some sellers may cut necessary expenses in order to inflate their earnings and show “growth.”For example, a seller may cut their pay-per-click (PPC) advertising for six months, which in turn causes their overall sales to drop. But their earnings (thanks to fewer expense dollars being deducted from their revenue) will increase based on the temporary momentum created from their PPC spending—at least in the short term month to month analysis. However, this strategy is usually detected by a savvy buyer, who quickly realizes that if overall sales are in decline, then total earnings are sure to follow.

Revenue Trending ll

Outside of the artificial earnings inflation via expense cutting, another factor considered is a business’ overall revenue trending. To be brief, achieving a certain mass of sales effectively proves a business has a saleable product or service. And as revenues increase, more upward pressure is placed on the multiple—even if the earnings aren’t necessarily increasing at the same rate. Strong performance, and the potential for even greater returns down the road, has a positive impact on multiples.

How strongly does trending impact the multiple?

Whether a business is trending toward strong growth, steep decline, or simply plateauing, financial trending is the strongest influence on the multiple. Businesses on the grow will experience upward pressure on their multiple, while declining or plateaued businesses can expect to take a serious hit. Most buyers will want to see at least a year’s worth of trending data for analysis, although having two years of data (so that the buyer can perform a year over year analysis) is always preferred. The stronger the growth or decline, the greater the impact on the multiple.

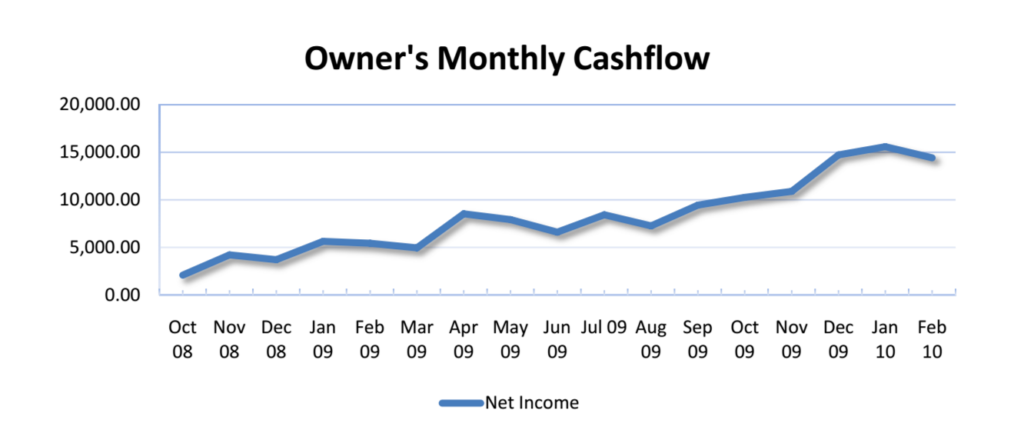

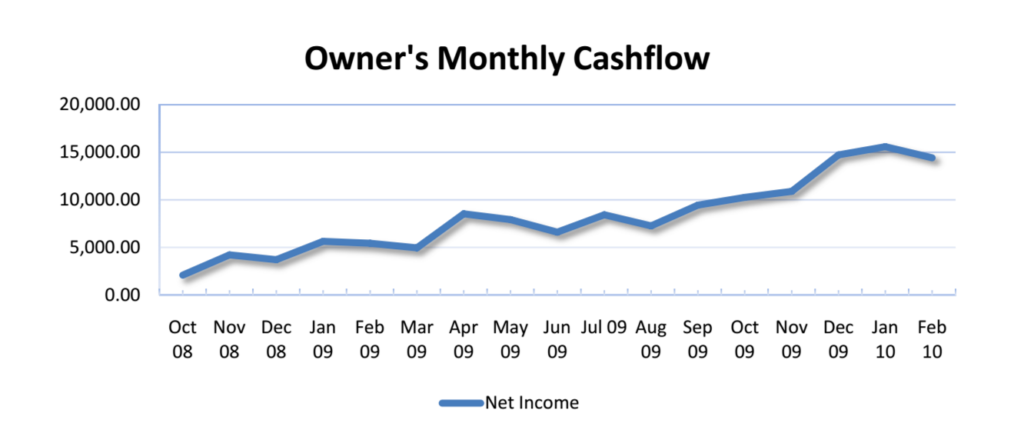

To Sell, or Not to Sell

It’s hard to complain if your business is experiencing strong growth, because growth has such a powerfully positive effect on the multiple. However, if growth is too strong, it may not make sense to sell your business, as the increase in earnings changes significantly with each new month. The trailing 12 months (TTM) of business provides the discretionary earnings portion of the valuation formula (value = TTM Earnings x Multiple) when calculating the valuation. So every month you add to your TTM, you also add a multiple of that increase to your value. Example: Sometimes, a little patience can pay off handsomely—and selling too soon can cost you. For example: if your business has a multiple of three, and every month you add $50,000 to its discretionary earnings, then every month you’re adding $150,000 worth of value to your business. A monthly uptick in the multiple you receive for your business may not, in the long term, compare to the added value your business would accumulate throughout an extended period of growth. Waiting until the growth spurt slows to more modest levels will put you closer to where you want to be as a seller.

Want Another Example?

We analyzed a client’s case study to see whether holding on to his business was a good decision. This is a detailed study in the value of holding vs. selling your website. Read More.

Can you sell a business in decline?

Selling a business in decline is absolutely possible, but you can expect significant downward pressure on the multiple depending on the severity of the decline. In addition, since the multiple is applied to your TTM earnings, with every passing month, the TTM earnings will move downward. As we mentioned in the Financial Trending section, buyers are extremely likely to assign a much lower multiple to businesses in decline.

Time Cost to Run a Business

Most people do not want to “buy a job,” and the amount of time it takes to run the business is an extremely important metric for buyers. Time is an asset, and how much of it is required to generate a return from a business will definitely influence whether a buyer views that business as an opportunity or a non-starter. Depending on their goals and capabilities, potential buyers may plan to take over the day-to-day operations of the business, or opt to outsource its key roles. In either case, a buyer will prefer a business that takes less time to run.

Taking Over Operations vs Outsourcing

For buyers who plan to take over day-to-day operation of your business, avoiding the equivalent of an hourly wage job will an important consideration. Consider this example: A buyer acquires a business which takes 35 hours to run each week, and generates $45,000 in earnings every year. Assuming the buyer works 50 weeks a year, their total time investment is 1,750 hours, or the equivalent of taking a job that pays $25.71/hour. Most buyers would likely agree that such an acquisition holds little appeal. The desire to avoid buying themselves a job leads many buyers to outsource the day-to-day operations. But this option, too, comes at a cost. They’ll be investing capital instead of time, and the question they’ll have to ask themselves is this: Once outsourcing costs are factored into the expenses of a business, does that business remain a strong prospect for acquisition? Let’s take the business above, and remove the time commitment by outsourcing the day-to-day operations at a cost of $12,000 annually. The buyer’s anticipated earnings are now $33,000, rather than $45,000—meaning they are paying, in effect, a much higher multiple for the business due to this new expense. Even with a higher multiple, however, the purchase may still be a smart choice for the buyer. Freed from the time commitment, the owner will be free to use their time pursuing additional opportunities that, when combined with the $33K generated by the business after outsourcing, may generate more income than the original $45k.

Potential Opportunity

If you have a businesses you’ve placed on “auto-pilot” that only requires a few hours’ worth of work each week, some buyers may see significant opportunities at hand. For some buyers, the attraction of a “hands-off” business lies in potential growth and performance that have been left untapped. Although this isn’t as strong a motivator as, say, strong growth or proven performance, some owners view an investment of additional time (as compared to the existing owner) as a powerful way to take the business to another level and generate higher earnings.

How significantly does time impact a multiple?

Time invested is one of the rare metrics that can actually impact a multiple more positively than negatively most of the time. For a business that requires very little work (and has a strong history of maintaining earnings on low workloads), there is significant upward pressure on the multiple. Conversely, high-workload businesses (with that same strong history of maintaining earnings) will place downward pressure on the multiple—but not, it should be noted, as powerfully as a low workload business exerts upward pressure. The exception to this would be when the workload of a business is high and the earnings are relatively low, at which point significant downward pressure is applied to the multiple. As we move ahead to Part II in Chapter Seven, we’ll explore the ways in which the age of your business, its margins, and the traffic it generates affect the multiple.

Chapter 7. Major Measurable Metrics II: Business Age, Margins, and Traffic

Now that we’ve had a look at how financial trending and time cost affect the multiple, we can turn our attention to the final three major measurable metrics buyers will examine when assigning a multiple to your business. In this chapter, we’ll focus the spotlight on business age, financial margins, and traffic.

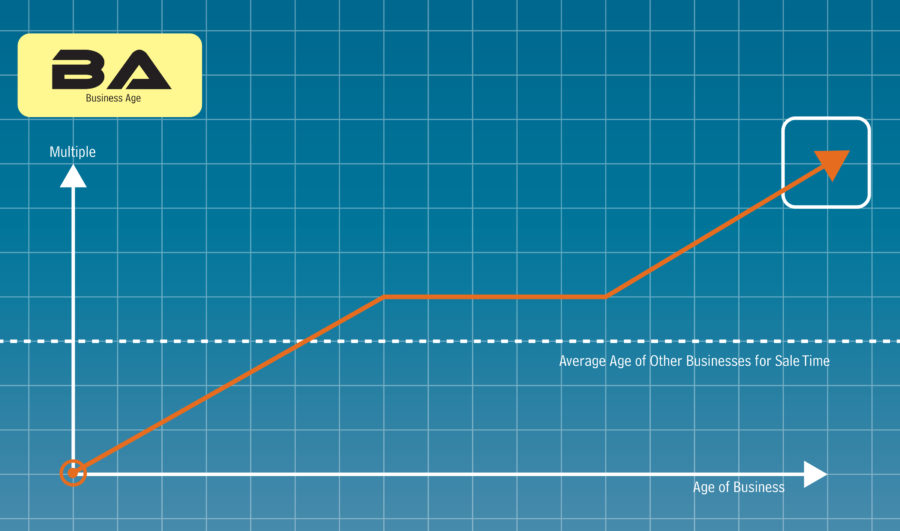

Business Age

No, we’re not talking about a historical time period when three-piece suits ruled the earth. We’re talking about the age of your business. Buyers are highly concerned with the age of a business, and with good reason. Generally speaking, a multiple will experience downward pressure if the business to which it is applied is younger than the average age of other businesses for sale. That same multiple will experience upward pressure if the business is older than the average age of the business. And if it is around the same age of the average business for sale, the multiple will be unaffected.

Why Age Influences the Multiple

Age influences the multiple in several key ways:

- Resilience. An older business shows resilience in light of changing environments. It’s also likely the business has encountered, and survived, numerous challenges.

- Accumulation of Goodwill. One of the most valuable, if difficult to quantify, aspects of a business is just how much goodwill it has built up with people who have interacted with the business. Reliability, good press, and customer loyalty demonstrate the less tangible value of the business, and help buyers see the place it holds in its community and market. A business that’s been around for quite a while has more opportunity to build strong relationships with clients, vendors, and the press, and can accumulate more goodwill.

- Potential for Authority. Older businesses are often granted a certain authority by consumers and—provided their sites are well-built and use SEO best practices—by search engines. Buyers can leverage this authority to expand their reach, influence the market, and grow the business.

What is the Ideal Age for Selling a Business?

If you’re ready to sell, then your business should (ideally) be at least three years old. When a business is younger than three years old, a short track record can cause buyers to discount the multiple they are willing to pay for that business.

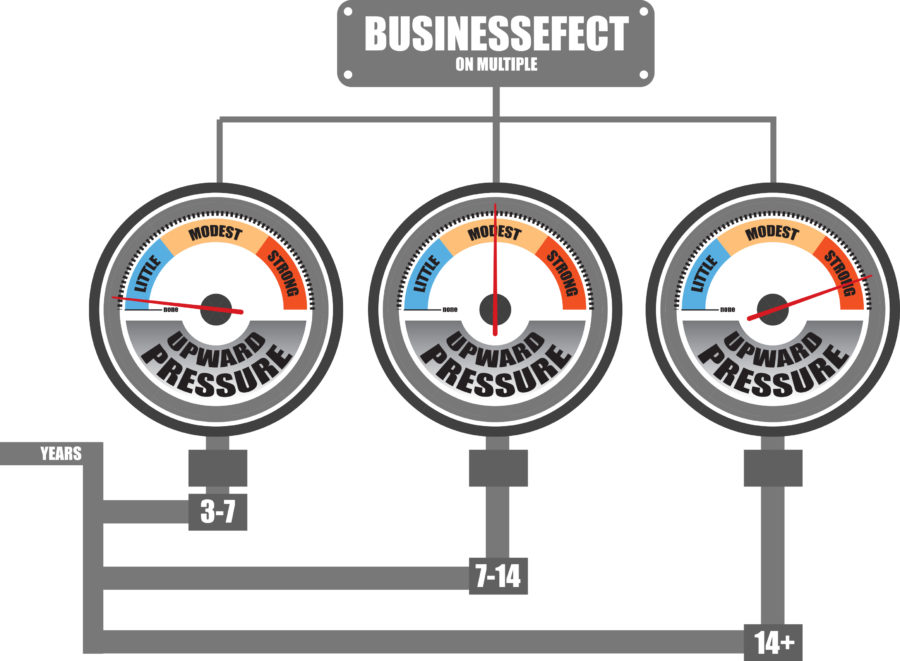

Does Old Age Improve My Multiple?

Old age will improve a company’s multiple, although not as dramatically as being too young will push it downward. In general, the age of business that is three to seven years old will have little to no effect on the multiple. A business that is 7-14 years old will receive a modest amount of upward pressure on its multiple. Businesses that have been around for more than 14 years often use their longevity as a unique selling point, generating strong upward pressure on the multiple.

Can I Sell a Young Business?

Selling a young business is definitely possible, but you can expect to take a significant hit to your multiple. Unless you have a very unique situation (e.g., YouTube, which sold in October 2006 after being founded just a year earlier), you will likely be taking a significant discount. Accumulating just 12 months of history will improve your multiple. Building 24 months or 36 months will provide even better results, with a significant boost for each milestone.

How Strong is the Influence of Age on the Multiple?

Overall, age is a significant influence on multiples. If your business is very young, age has such a strong influence that it can kill the possibility of doing a deal outright. However, as you get closer to that median age of 3-7 years, the impact lessens, until you start to move toward the 14+ mark, at which point upward pressure begins to build more strongly.

Financial Margins

Margins give an indication of profitability and the level of competition in an industry, generally described as the sales required to reach a certain percentage of earnings (Sales x Margin (%) = Earnings). Margins can be “thin” (small) or “fat” (large). Generally speaking, when margins are very thin, competition is driving down prices. In a tightly competitive market, small margins leave a buyer little room for error or added expenses.Small margins also make it more difficult to generate acceptable earnings. When a business has highly profitable margins, a buyer has less work to do in order to generate earnings, and the business becomes much more attractive as an investment. Understanding margins is critical to valuation because, they exert such strong influence on the multiple in a variety of ways:

- It is harder to make acceptable earnings (you need to move more product, sell more services, or garner more traffic) with smaller margins.

- Changes in fixed costs can make your business unprofitable. For example: if your bottom line margins are less than 10%, a small upward tick in expenses can reduce your profits significantly.

- High-margin businesses allow owners to invest at a more discretionary pace. These owners have more profits to spend on research, new website developments, new innovations, more aggressive advertising, etc.

- High-margin businesses offer a longer term protection. Business owners who see signs of a tightening or increased competition in their industry will have time to exit before the margins get too thin.

Important Margins To Watch

There are two primary margins buyers monitor:

Gross Margins

The percentage of total sales revenue your company retains after deducting all direct costs associated with producing the goods and services your company offers is the gross margin. Buyers take a close look at this value, because it gives them a sense of the fixed costs associated with your business. Buyers are often on the lookout for ways to improve the expense profile of a business, but as gross margins are typically exempt from significant fluctuation, they’re not generally an area where such improvements can be made. This is due largely to the fact that gross margins are often determined by the realities of the industry (e.g., vendors have fixed costs for their products) that are outside the business owner’s direct control. If a business sees 35% gross margins, an owner knows that they will need to generate $100,000 in sales to get (at most) $35,000 in earnings, assuming no other expenses. Of course, a seller may argue that higher margin products can be offered or promoted, but gross margins generally represent a certain ‘baseline’ for earnings.

Net margins

Net Margin is the ratio of a company’s net profits to revenues—typically expressed as a percentage—illustrating how much of each dollar the company earns translates into actual profits. The formula for net margins is a simple one: Net Profit/Revenue = Net Margins NOTE: Net Profit = Revenue – Cost of Goods Sold (COGS) – Operating Expenses – Interest and Taxes A business may have strong gross margins, but if it’s carrying a heavy expense profile, its actual earnings may be relatively small. For example, an online magazine will have high gross margins (possibly 100% since there are no cost of goods sold), but if it has high-profile, expensive writers, operating expenses could drop net margins too low to appeal to buyers. Low net margins can be a sign of an opportunity for a savvy buyer, but more often than not, they represent a business that requires significant overhead in order to generate relatively modest earnings.

What are “Healthy Margins”? It Depends on the Niche

Both the type of business you operate and the niche in which you do so will affect margins. For example, e-commerce businesses typically have margins between 20% – 35%. Ad-supported websites, on the other hand, often see margins that can easily reach 80% or higher. The health of your margin (and its influence on your multiple) depends in part on how your margins compare to others within your industry. But as with other metrics, the rule of thumb says higher margin businesses tend to garner higher multiples.

How Strongly do Margins Impact the Multiple?

Financial margins have a moderate amount of impact on the multiple. As with any metric, the closer your business is to average, the more likely this metric will have no effect on your multiple. When your margins become surprisingly small or surprisingly large, they can place corresponding pressure on the multiple. As with other aspects, it is harder to place upward pressure on the multiple than it is to place downward pressure on the multiple.

Traffic

People who ask us for a valuation of their website often point to their traffic as a merit with inherent value of its own. This is a common mistake. While traffic can be a major influence on the multiple in certain situations (and while it is always of consideration to a buyer), its influence on total value usually shows up as an indirect or complementary influence, rather than a direct one.

Traffic is not a major influencer of the multiple unless the traffic is:

- a) not to be trusted for some reason

- b) so eye-poppingly huge that buyers will be see it dripping with potential

The reason we list traffic as a major influencer of value is because of its close relationship to earnings. Earnings and traffic are sisters—you can’t separate the two. So whereas other major influencers have an impact on the multiple side of the equation, traffic influences earnings.

The Correlation Between Traffic and Earnings